Pakistan’s deteriorating economic situation has become a burden for citizens in the country, causing many businesses to shut down, resulting lay-offs and increased unemployment. To ease this issue, the Punjab government has introduced the ‘Punjab Rozgar Scheme.’

Daily wagerers, labour class, employees, and small business owners all are experiencing a halt in their monthly incomes with less and less to spend.

As of now, it has become increasingly challenging for the common man to survive amidst the crisis in the country.

Punjab Rozgar is a channel to provide sustainable interest-free loans to needy families, allowing them to set up a livelihood.

In this article, Graana.com— Pakistan’s smartest property portal, explains all the details regarding the government of Punjab’s Rozgar Scheme.

| Salient Features of the Punjab Rozgar Scheme |

| Step by Step Process to Apply for the Punjab Rozgar Scheme |

| FAQs |

Salient Features of the Punjab Rozgar Scheme

One of the main drivers of economic development is the growth of small and medium-sized businesses, which are the foundation of a nation’s economy.

Reviving these enterprises is a crucial part of restructuring the Pakistani economy in light of the current scenario. These companies don’t have access to finance sources, despite their value to the economy.

The Government of Punjab has been working on several uplift programmes to help the underprivileged, which have been combined into one programme called Hukumat e Punjab Rozgar Scheme.

In order to support small businesses with subsidised loans between Rs. 100,000 and Rs. 10,000,000, the Punjab Small Industries Corporation (PSIC) and The Bank of Punjab initiated this project.

Key Features of the E-Rozgar Scheme Punjab

Following is a complete list of all the requirements to register for the Punjab Rozgar Scheme.

| Particulars | Key Features | ||||||

| Age | 20 to 50 years | ||||||

| Gender | Male/Female/Transgender | ||||||

| Qualification & Experience |

|

||||||

| Residence Status | Citizen of Pakistan, Resident of Punjab verified through CNIC | ||||||

| Business Type | Applies to New & Existing Business Both | ||||||

| Loan Limit | Clean: Rs. 100,000/- to Rs. 1,000,000

Secured: Above Rs.1,000,000 up to Rs. 10,000,000 |

||||||

| Loan Tenure | 2 to 5 years (including 6 months grace period) | ||||||

| Loan Type | Term Based Loan | ||||||

| Equality Ratio for Debt | Males= 80:20

Females, Transgender & Disabled= 90:10 |

||||||

| Security Requirement | Up to Rs. 500,000/-:

Personal Guarantee of Borrower along with net worth statement Above Rs. 500,000/- up to Rs. 1,000,000/-: Personal Guarantee of borrower + (At least 01 Third Party Guarantee having collective net worth at least equal to the amount of loan OR Guarantee of Government Employee of BPS-10 and above.) Net Worth may be in the form of Tangible Asset i.e Property or Vehicle ownership, and may be assessed as follows: a) Property may be valued at DC rate by the bank. OR b) Property valuation may be established from Wealth Tax statement. OR c) Evaluation by Pakistan Banks Association (PBA) approved evaluator OR d) Vehicle valuation shall be Purchase price less Depreciation (10% for each passing year). Third party should be a citizen of Pakistan and resident of Punjab having a valid CNIC and must not be older than 55 years. Moreover, e-CIB of third party should be clean i.e it should not have any overdue or write off history. Above Rs. 1,000,000/- up to Rs. 10,000,000: Mortgage of Residential / Commercial / Industrial / Agricultural Property / Vehicle having clean title and clear access acceptable to the bank. |

||||||

| Pricing |

|

||||||

| Sectors | Applicable for all sectors | ||||||

| Applications | All applications shall be submitted online through the portal designated by PSIC | ||||||

| Processing Fee | Rs. 2,000/- (Non-Refundable) |

*Source: Bank of Punjab Official Website

Step by Step Process to Apply for the Punjab Rozgar Scheme

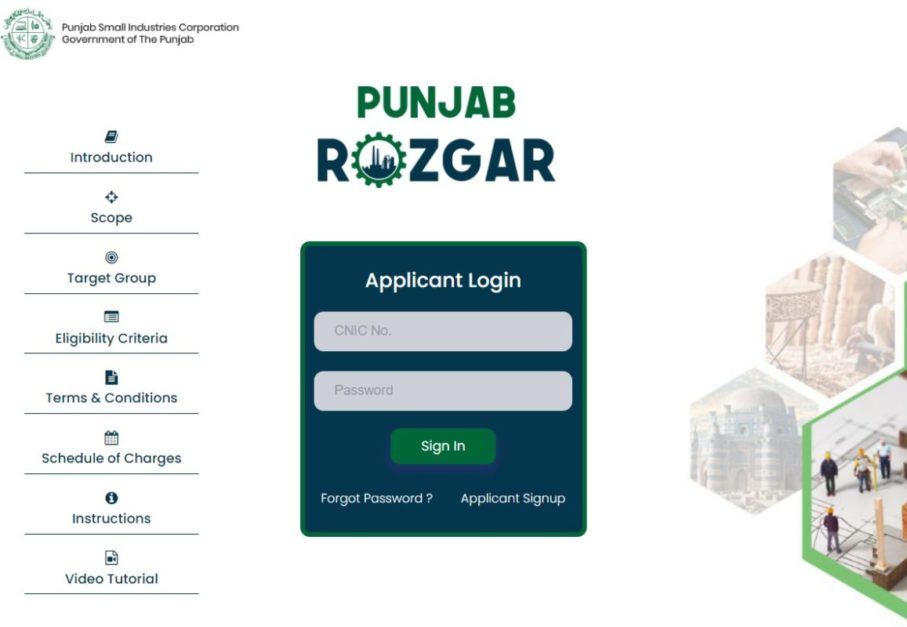

If you’re looking to apply for this programme, the following is a step-by-step guide that you can follow. The first part is to make an account, followed by the next step – filling in the application.

Register Your Account for Punjab Rozgar Scheme

- The first step is to visit the official Punjab Rozgar Scheme website.

- Click on the ‘Applicant Sign Up’ Button.

- Once you click on Sign Up, an application form will open. Complete the form by adding your complete details; Full name, CNIC, Email address, Contact Information, and Password.

- Once you’ve added in the details, click on ‘Register’. You’ll receive an OTP (One Time Password) on your mobile phone.

- Add the OTP password to complete your registration.

- Next, sign in to the account using your CNIC and Password.

Completing Application for Punjab Rozgar Scheme

- After signing into your account, click on ‘New Application’

- Read all instructions provided carefully before filling your application. You can find the instructions in both Urdu and English.

- Add complete details in your application form regarding your business information, personal information, credit history, and references.

- Review your application and submit it.

Frequently Asked Questions Related to Punjab Rozgar Scheme

This initiative by the Punjab government is a brilliant opportunity for people who are finding it difficult to make ends meet.

Through this loan, they can easily set up a small business for themselves to make a livelihood themselves. There are a lot of questions that are asked by people regarding the E Rozgar Scheme.

Following are some commonly asked questions that might help in clearing out any further confusion you may have.

- Can a government employee secure a loan through this scheme?

No. Government employees have a monthly source of income and allowances that fund their livelihood. This scheme is specially designed to assist underprivileged people.

- What is the Repayment Period for the loan?

You can pay the loan back in easy instalments within the time period of 2 to 5 years.

The launch of this scheme is a brilliant step towards improving the lives of the destitute in the country. This program also implies to students who are looking to set up a business. For more information and updates on the latest developments, visit Graana Blog.