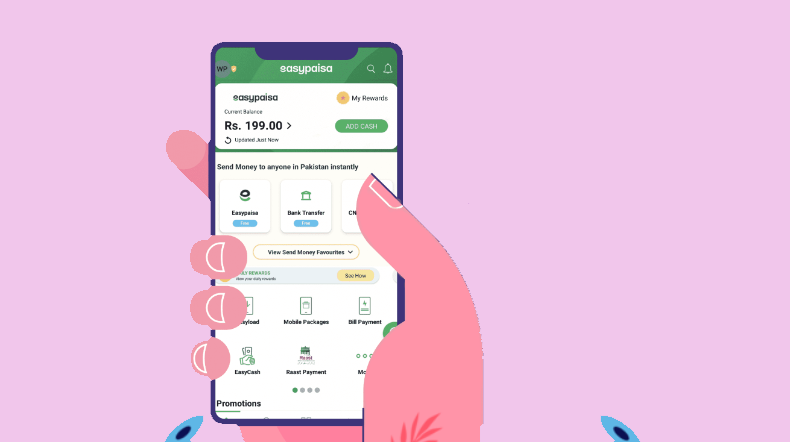

Easypaisa is one of the first online banking service providers in Pakistan, through which you can transfer money, pay bills, and perform various other tasks using your mobile phone. The features offered by this service provider have made handling finances much more convenient for the majority of Pakistanis. Through an Easypaisa account, you may simply pay your electricity bills and transfer money using your cell phones, all without leaving the premises of your home.

Graana.com features a step-by-step guide to creating an Easypaisa account.

The Basics – What is an Easypaisa Account?

In Pakistan, an Easypaisa account is a mobile wallet and financial services platform. It enables users to carry out several financial operations, including bill payments, money transfers, mobile top-up purchases, and even online shopping.

Easypaisa accounts offer a quick and easy way to handle money and financial tasks using a mobile device. They are connected to the user’s phone number. For routine financial transactions, it’s widely used, and people who might not have access to traditional banking services find it particularly appealing.

How to Open an Easypaisa Bank Account?

Follow the guidelines given below to open an Easypaisa bank account.

- Get the mobile application.

- Launch the app after it has been installed successfully.

- Enter your cellphone number.

- Enter your CNIC number and the date it was issued. Your CNIC card can also be scanned.

- For account creation, create a pin code consisting of five digits.

- By texting their mobile number to 0345-1113737, non-Telenor subscribers can also register for the respective account. The message should be sent to 0345-1113737 using the EP<space>CNIC number as the recipient.

Steps to Open An Easypaisa Account?

Following is a step-by-step guide to opening an account for both Telenor and Non-Telenor users.

Telenor Users

If you are already a Telenor user, follow these steps.

- First, dial *786# from your phone, this will open your account.

- Now make a pin code for this account with five digits.

- Re-enter the generated pin code.

- There you go, your account has been created.

- To take advantage of all of the services, dial *786#.

Other than that, Telenor users can open an account by simply going to any local Telenor franchise or official outlet.

Non-Telenor Users

- Send “EP <space> CNIC number” to 0345-111-3737.

- A representative will call and request verification.

- You will be required to create a 5-digit pin code after verification.

- Enter the 5-digit PIN code once prompted.

- Send the verified 5-digit pin code to 0345-1113737.

Keep in mind that you must enter the pin code you created in the previously mentioned message. You will receive a confirmation SMS from the number 3737 after sending the message. The message will confirm that their account has been successfully activated.

You must go to an EasyPaisa shop to finish the verification process in order to fully authenticate your account, which will be carried out via biometrics.

Process of Adding Money to Your Easypaisa Account

Now that the account has been generated, you can now add money to your Easypaisa account. The money can be deposited using:

- Bank transfer from any bank account to any of the 75,000 Easypaisa locations nationwide.

- Transfer the amount from another Easypaisa account.

Anyone with a local or international Visa/MasterCard Credit or Debit Card can top up their account using any Visa/MasterCard.

Advantages

As we just indicated, Easypaisa has transformed people’s lives through the profuse services that they offer. Moreover, it has revamped digital banking in Pakistan as well.

Here is a list of the advantages of using this online banking application.

- You may quickly pay all your utility bills using your smartphone and Easypaisa. Simply launch the app to pay bills.

- You can control every aspect of your financial transactions with a smartphone.

- Compared to other online money transfer providers, the service charges are relatively lower.

- Using the account, you may also transfer money to other banks.

- You can also avail of insurance offers from the app.

- Additionally, you can add money to any network’s prepaid balance. It also offers postpaid users to pay their bills as well.

- Along with bills and utilities, the platform allows users to pay for recreational activities as well, such as purchasing movie tickets.

- It now offers the service of ATM cards that can be used nationwide.

FAQs

Is there any fee to open an Easypaisa account?

No, there is no fee to open an account.

How can I deposit money into my Easypaisa account?

You can deposit money into your account by visiting an Easypaisa retailer or by transferring funds from your bank account.

Is my money safe in an Easypaisa account?

Yes, your money is safe in an Easypaisa account as it is regulated by the State Bank of Pakistan and is subject to strict security protocols.

Can I link my bank account to my Easypaisa account?

Yes, you can link your bank account to your Easypaisa account to transfer funds between the two accounts.

How can I check my Easypaisa balance?

You can check your account balance by dialing *786# from your mobile phone or by logging into the app.

What should I do if I have an issue with my Easypaisa account?

If you have an issue with your account, you can contact the Easypaisa helpline at 3737 or visit a retailer for assistance.

How can I make an Easypaisa account without CNIC?

Unfortunately, creating an account without a CNIC (Computerized National Identity Card) is impossible. This is because the CNIC serves as a valid form of identification and is required to verify your identity and prevent fraudulent activities. Therefore, you must have a valid CNIC to open an Easypaisa account in Pakistan.

How much money can we deposit in the account?

The amount of money you can deposit into your account depends on your account type. The maximum balance limit for a basic account is Rs. 50,000. However, if you have an Easypaisa mobile account, you can deposit up to Rs. 1,000,000 in your account.

How to delete the Easypaisa account

To delete your account, you need to call the Easypaisa helpline at 3737 from your registered mobile number. Once connected, request to delete your account. The representative may ask for some details to verify your identity before processing the request.

Once the verification process is complete, your account will be deleted. It’s important to note that once your account is deleted, you cannot use any of the services offered by the platform and any remaining balance in your account will be forfeited.