In the second quarter of this year, commodity prices have been on an upward trend with the inflation rate touching double figures. This rise in prices, coupled with an increase in housing shortage, has impacted the real estate market – but in a good way.

Historically, the real estate market performs well in this kind of inflationary environment as people look for assets that serve as a hedge against inflation.

To look at the impact of inflation on real estate, Graana.com, Pakistan’s smartest property portal, provides a comprehensive analysis of different property investments and how they can help in keeping pace with inflation.

What Is Inflation?

Inflation refers to a decline in the purchasing power of people due to the general increase in the prices of goods and services.

As inflation starts to increase, the money you have loses its value, which impacts your spending ability. Hence, we can describe inflation as the rate of change in those prices over some time.

Causes of Inflation

According to the International Monetary Fund (IMF), inflation is expected to reach 11.5% in developing countries and 7.5% in developed countries on average over the course of this year.

This global rise in inflation can be due to various factors but there are two main reasons behind this spike: the war in Ukraine and global supply chain disruptions. These two factors have pushed the world’s annual inflation rate to the highest level since 1981.

However, the case is different in Pakistan as many overlapping factors are involved in this sharp rise in inflation, particularly the balance of payment (BOP) crisis.

To tackle this, the government had no other option but to seek aid from the IMF. However, the IMF hasn’t approved the loan tranche for the country so far, which has further accelerated the inflation rate.

Recently, the government has also increased electricity and fuel prices to manage the balance of payment. However, this surge in prices has increased commodity prices, impacting many industries in the country.

Inflation Impact on Real Estate Market

When it comes to real estate, the impact of inflation is mostly positive compared to other sectors. Historically, the rising inflation doesn’t affect real estate investors; they are the ones who benefit the most from this inflationary environment. The period of high inflation mostly affects people on the lower-income spectrum.

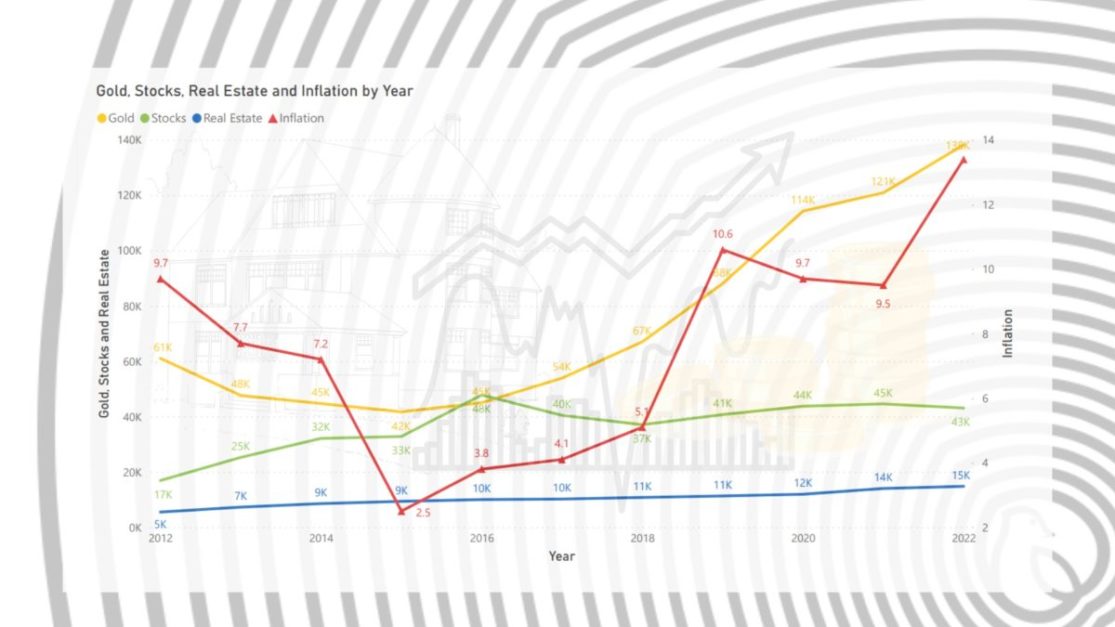

During the high inflationary period, most investors use real estate as a hedge against inflation as it offers more protection compared to other assets like stocks, gold, crypto, etc.

To be clear though, this period can have some negative impacts as well. In order to further explain the effects of inflation, we have shared a list of some positive and negative outcomes below.

Property Appreciation

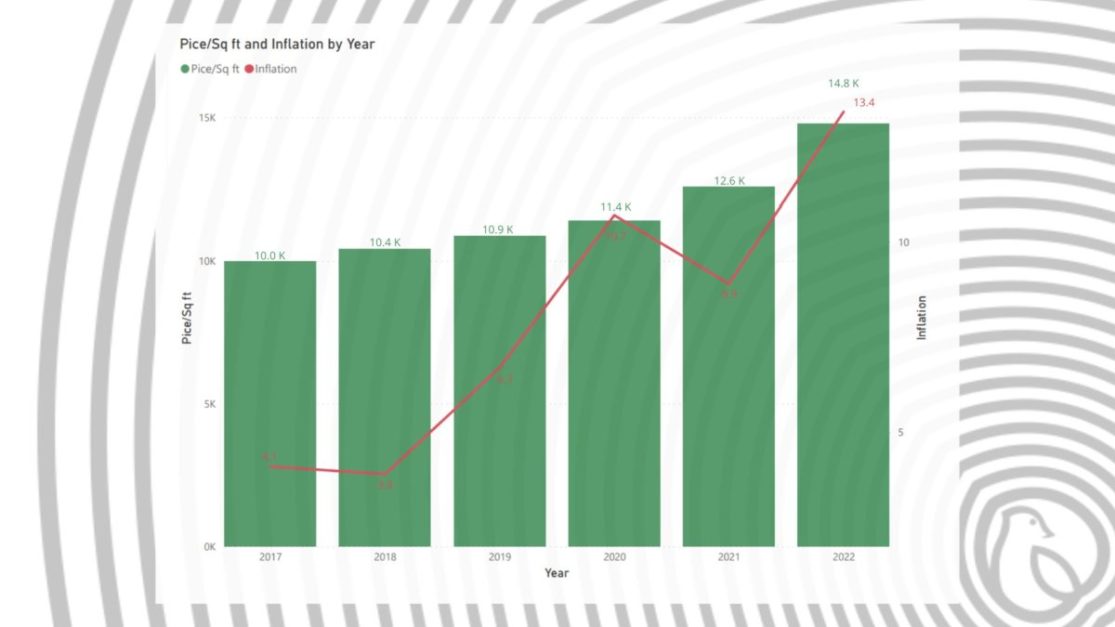

When we take a look at property data from the last few years, there is a massive appreciation in the value of the properties. For instance, if one had bought a property worth 1 million in 2018, it may be worth around 5 to 6 million rupees.

If we assume this appreciation in the property’s value and compare it with inflation figures, you would see that any investment in real estate would have beaten the inflation easily.

However, you have to be smart when investing in real estate as you don’t want to park money in properties that may not yield better returns. It is important to note that real estate investment does not work effectively in the short term as it takes time for the value of the property to appreciate. You need to hold the properties for some time if you want to generate positive returns in the long run.

Increase in Rents

Just like other commodity prices, rental rates tend to increase with rising inflation as well. This happens due to the increase in the demand for rental properties, as there is a decrease in the purchasing power of people.

Regardless of the value of the currency and inflation rate, property owners with rental income will be able to pay for the increase in expenses.

Negative Impacts of Inflation on Real Estate

Following are some of the negative effects of real estate due to inflation.

Rising Cost of Construction

One negative impact on real estate is the rising costs of all construction materials like bricks, cement, steel, etc. The prices of these materials move in tandem with inflation, causing the cost of constructing a house or building to rise sharply.

Increased Cost of Borrowing

Most central banks tend to increase interest rates with rising inflation. This affects the cost of borrowing who are looking to finance their real estate purchase. With the increase in borrowing and construction costs, building a new home will be difficult in this inflationary environment.

Best Real Estate Investments in Inflationary Environment

While real estate investments depend on the market, there are few investments that fare better than others, particularly rental properties. These include residential and commercial units that are likely to have higher demand and returns even in this global inflation.

You can also invest in REITs (Real Estate Investment Trusts), which is a good way of distributing capital across different assets.

While property investments protect you from inflation, it is pertinent to mention that it isn’t a short-term strategy. You have to plan it for the long haul as property prices will only appreciate after 4 to 5 years.

To know more about the impact of inflation on real estate, follow Graana blog.

Comments are closed.