The ouster of former Prime Minister Imran Khan, coupled with the double digit inflation, has brought about one of the most severe politico-economic crises in Pakistan. The political raucous, coupled with dwindling foreign exchange reserves – and that too at a time when import bill is at an all-time high – has brought the country to the point where some analysts are discussing bankruptcy.

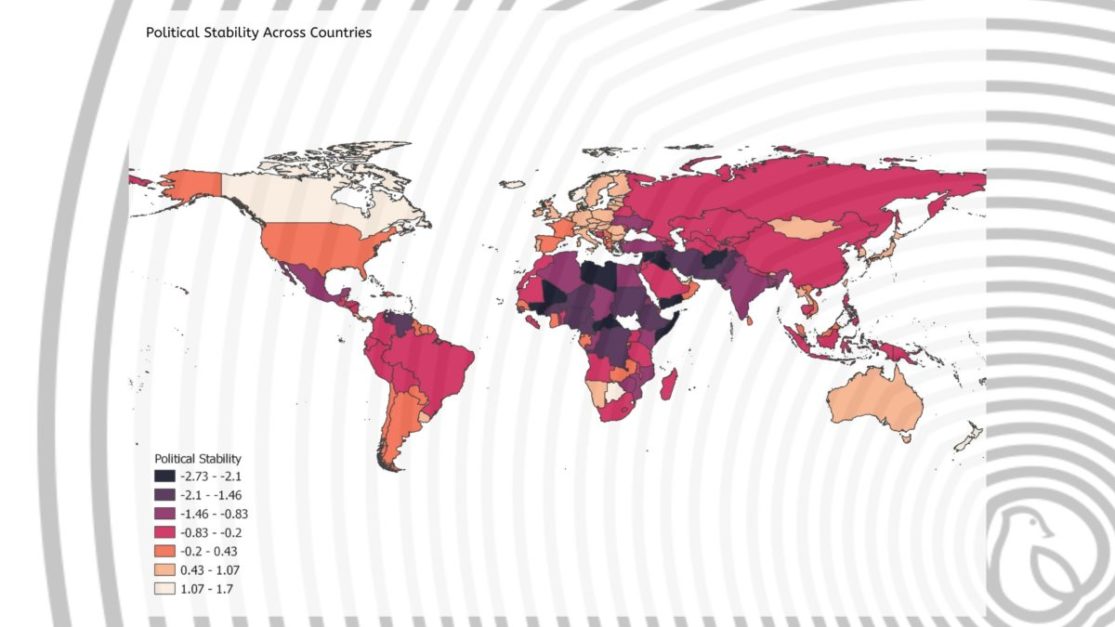

As per the political stability index for 2020, Pakistan ranked 184th out of 194 countries. Pakistan had a mean score of -1.85, which is at the lower end of the spectrum. This political instability is affecting Pakistan’s markets. The lack of investors’ trust in the government is making things difficult for the nation.

According to economic experts, the fall in equities and the rupee value was caused by an unstable political situation, depleting foreign exchange reserves, a balance of payment crisis, and uncertainty over the revival of the International Monetary Fund (IMF) loan programme, which could have improved the country’s balance of payments. Hence, the existing government needs to find a way to reduce subsidies on petroleum products and electricity in order to re-establish the IMF programme. However, the Federal Minister for Finance and Revenue Miftah Ismail stated on Sunday that, “The government is not increasing petroleum product prices for the time being.”

Graana.com, Pakistan’s smartest property portal, takes a look at the rapid devaluation of Pakistani rupee in the last month and how it has affected the purchasing power of the masses. In addition we take a look at the possibility of real estate as a hedge against inflation.

Devaluing Currency

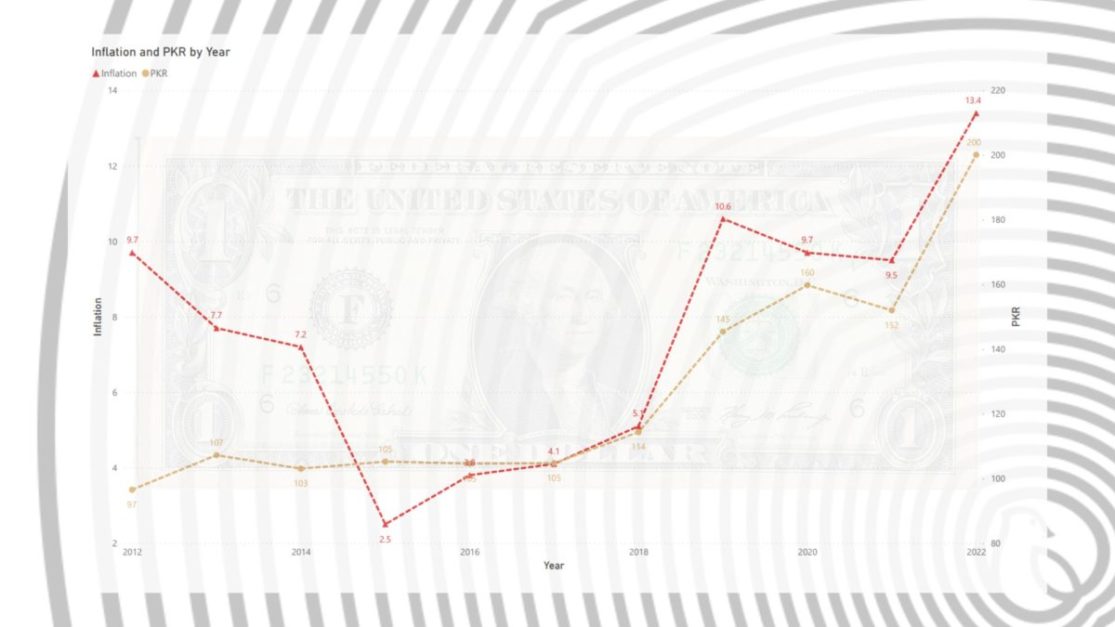

Last week, the Pakistani rupee continued to fall, hitting a new low of 200 against the US dollar in the interbank market. At the start of May, the USD was around PKR 185 and, over just the next few weeks, it increased an additional PKR 15.

Over the last five years, the country has seen a gradual increase in inflation, which rose from 4.1% in 2017 to 10.7% in 2020, ultimately dropping down to 8.9%. However, it crossed double digits and came to 13.4% in April 2022. ‘

Falling Stock Market

The KSE 100-Index of the Pakistan Stock Exchange (PSX) has fallen 1.88% or 819.14 points to close at 42,667.32 points (down from 43,486.46 points) in one week. KSE All-Share Index fell 1.71% or 506.00 points to finish at 29,067.73 points; the KSE 30-Index fell 1.99% or 329.05 points to finish at 16,212.92 points; the KMI 30-Index fell 2.35% or 1,660.57 points to finish at 68,861.78 points; and the Islamic All-Share Index fell 2.03% or 434.43 points to finish the trading session at 20,922.27 points.

The main index also moved 1,111.07 points during the trading session, indicating bearish trends. The main index reached an intraday high of 43,486.46 points and an intraday low of 42,375.39 points during the trading day. The market saw 250.328 million shares traded. Compared to 208.10 million shares traded on Friday, turnover was down 20.29% or 42.228 million shares. Out of 351 active scripts, 67 concluded the day in the green, 269 ended the day in the red, and the valuations of 15 other listed businesses stayed unchanged.

Causes of Inflation

The war in Ukraine and an incessant global commodity supercycle have pushed inflation to the highest levels worldwide, in both developed and emerging countries.

This spike in inflation is also due to the oversupply of demand as the world recovers from the impact of the COVID-19 pandemic. There are also several other overlapping factors like fiscal policy, corporate policy and manufacturing costs affecting the prices of goods and services.

In the case of Pakistan, the volatility on the political front, followed by the balance of payment crisis and surge in global commodity prices, have led the inflation into double digits. According to the Pakistan Bureau of Statistics, inflation has risen to 13.4% in April compared to 12.7% in March 2022. The average inflation rate from July-April is 11.04% compared to 8.62% from the corresponding period last year.

The country depends on imported energy and food, which results in an increase in inflation. So, any increase in fuel prices will have an impact on the prices of goods and services.

Inflation Hedging

Hedging against inflation can help protect an investment’s value. Certain assets may appear to offer a good return, but after inflation is taken into account, they can be sold at a loss. For example, if you invest in a stock that returns 5% but inflation is 6%, you will lose 1% of your investment. Investors flock to inflation-protected assets, which keep their prices high despite their fundamental value being substantially lower.

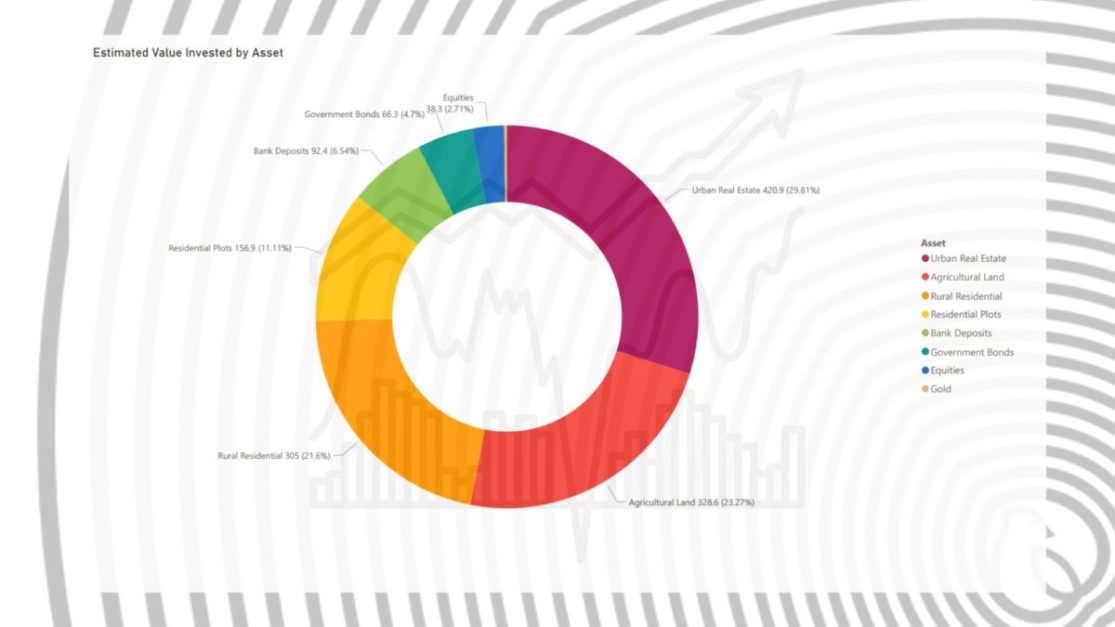

Where Pakistanis Invest

According to the data above, urban real estate is the leader among all other investment opportunities in Pakistan. The sector stands at a total estimated value of PKR 420.9 billion, contributing 29.81% of total investment value.

Real estate investment is followed by agriculture land investment, which shares PKR 328.6 billion (23.27% of total investment), rural residential investment sharing PKR 305 billion (21.66%), residential plots sharing PKR 156.9 billion (11.11%), and bank deposits sharing 92.4 billion (6.54%).

The main reason for real estate being the most-invested asset amongst all other options is its non-volatility, the risk association being little to none, and its gradual but increasing rate of returns.

How to Use Real Estate as a Hedge

In a volatile economy that’s heavy on demand and short on supply, we need to include assets that are considered hedges against this inflation. Basically, these hedges move in the opposite direction to the market as it saves one from events like inflation.

There are a number of approaches one can take, most notably investing in real estate. According to industry experts, investing in real estate in this economic situation is a good option as the prices of property tend to remain on the higher side.

One way to use real estate as a hedge against inflation is to invest in different types of residential and commercial properties.

Another example of inflation hedging through real estate is rental properties. Investors, for instance, can purchase rental properties in a metropolitan area and earn good profits. Taking a look at the appreciation of property value in the past five years can be a fairly good indicator that the initial investment is secure and they will be receiving a monthly rent. In case they decide to sell the property, they will not only recover their initial capital but will sell it at an appreciated value.

Real Estate: Not a Short-Term Strategy

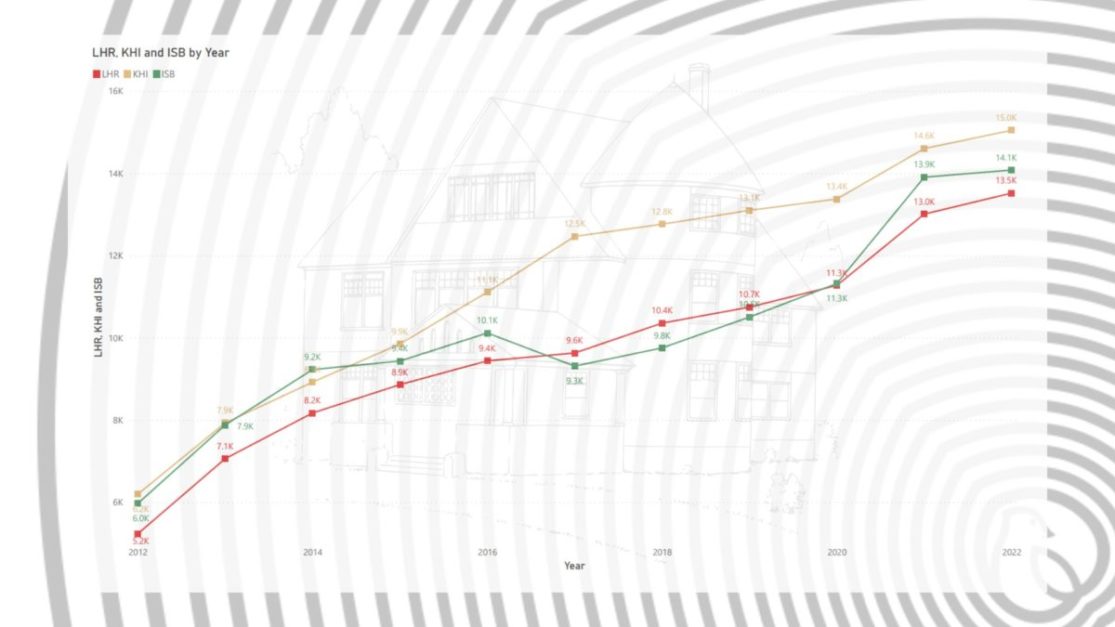

It is important to note that real estate is not an effective short-term strategy for hedging against inflation. You need to look at the property’s value over the longer term. Looking at the property trends of different cities for the last 10 years, real estate does seem to offer more protection to the invested capital. The data suggest the total returns across different cities vary but it shows that real estate delivers positive returns over the years. This is why many investors who consider predictability and security of capital as major investment objectives should invest in real estate.

For instance, if the residential property price in Karachi was PKR 1 lac in 2012, the price of that property may be around PKR 25 million in 2022. The appreciation in property value varies due to different factors like location, demand/supply, future development plans etc.

You also need to consider the differences between various property types. According to our analysis, residential properties do offer better returns if they are held for a longer period. Some commercial properties may offer positive returns but there are many risks involved in this type of investment, such as cyclic supply/demand imbalances that are correlated with inflation.

While the investment in real estate is best suited for long-term investors, there are some opportunities in the market that can generate positive returns over the next year or two, even in a global inflationary environment.

Housing Shortage

Housing affordability is becoming a serious problem in most countries but, even by global standards, the situation in Pakistan is dire. The average urban Pakistani household had 1.9 earning hands and a total household income of roughly PKR 53,000 per month, according to statistics from the Pakistan Bureau of Statistics’ Household Integrated Economic Survey. This equates to PKR 636,000 per year.

The cost of an urban house or apartment is approximately PKR 11.7 million according to estimations based on the Pakistan Bureau of Statistics, which is approximately 18.4 times the average salary. The ordinary household cannot, by any means, afford a personal house.

Personal finance experts believe that a house should not cost more than four times a person’s annual salary. If you earn PKR 53,000 per month and live in Lahore, Karachi, or Faisalabad, you can buy a home costing PKR 2.5 million. There are a few decent properties in that price range, but not many.

That, of course, implies that the average individual has the kind of funds required to make a 25% down payment on a property and then qualify for a mortgage on it – all of which is theoretically feasible but practically challenging.

There is a housing scarcity and the housing-related sector of the economy – building, materials, etc. – is significantly smaller than it should be, which has a cascade effect on the rest of the economy.

Other Options Besides Real Estate

Following is a comparison between different types of investments.

| Factors | Real Estate | Gold | Bank |

| Capital Requirement | High | Moderate | Low |

| Returns | High | Moderate | Low |

| Taxes | Yes | No | Yes |

| Liquidity | Moderate | High | Depends on Acc. Type |

| Volatility | Moderate | Moderate | Low |

| Security | High | Moderate | High |

Real estate is not only the most secure investment opportunity, but it also offers positive rates of return.

Stocks

According to Graana.com, the average rate of return in stocks stands at a whopping 16%, compared to stocks that have an average rate of return of 10%.

Moreover, stocks are risky and volatile, and one would need to have the comprehensive financial knowledge to invest in them. Prices of stocks may vary quickly and abruptly, adding to the risk element. It may be necessary to hire a stockbroker or financial advisor to guide in the process. This would, however, increase the overall cost of investment as brokerage fees would have to be taken into account.

On the other hand, real estate investment is relatively nonvolatile and safe, with high returns and a lower risk of depreciation.

Gold

Another investment option in Pakistan is gold. The price trends of gold in the last five years is a clear indicator that it is a safer investment when compared to stocks or bonds. It has appreciated 180% from PKR 131,606 in May 2017 to PKR 369,133 in May 2022 per ounce. However, it is important to note that gold took a hit in August 2020, when it dropped from PKR 331,559 to PKR 257,856 per ounce in March 2021.

Forex

When it comes to different investment options in Pakistan, one other alternative that comes to mind is forex trading, which is the trading of different currencies. Forex trading is known for its convenience and ease, as you can start with as low as PKR 1000. However, like gold investment, forex trading also comes with plenty of risks, as the prices and returns are highly volatile. Again, you will need an in-depth understanding of the forex market to start trading, otherwise you could easily fall for any scam associated with this investment.

According to Investopedia, as of April 2019, the spot FX market, which includes currency options and futures contracts, exchanged about $6.6 trillion each day. With such a large quantity of money moving about in an unregulated spot market that trades instantly, over the counter, and with little accountability, forex scams entice unscrupulous operators to make quick money.

Savings Account

Another investment option besides real estate is a savings account. A saving account is a simple bank account that lets you deposit money, keep it safe, and withdraw it while receiving interest. Most banks, credit unions, and other financial institutions provide FDIC-insured savings accounts that pay interest on your money.

You can open a savings account with a small deposit of PKR 500. The interest rate on bank savings accounts in Pakistan ranges from 4.15% to 11%. This means that if you put PKR 500 in your account, you will receive PKR 556, plus an interest of 11%.

A savings account is one of the safest investment options, as the rate of returns is fixed and offers minimum risk. However, with that being said, the profits and returns in real estate are much higher than in savings accounts. Moreover, the risk associated with real estate is even lower.

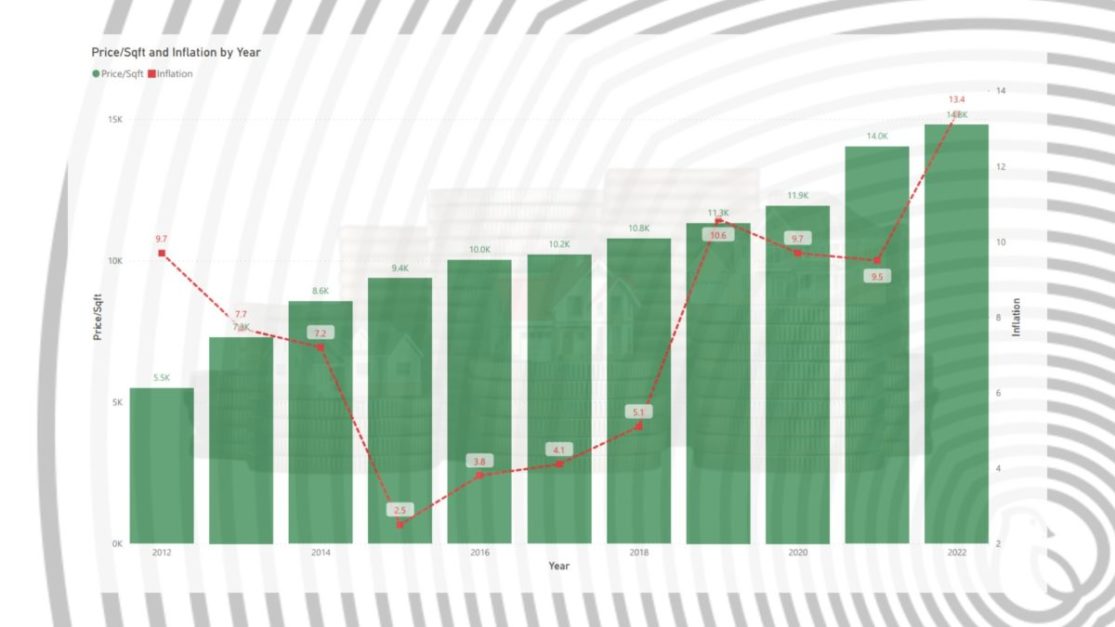

Real Estate: A Stable Investment

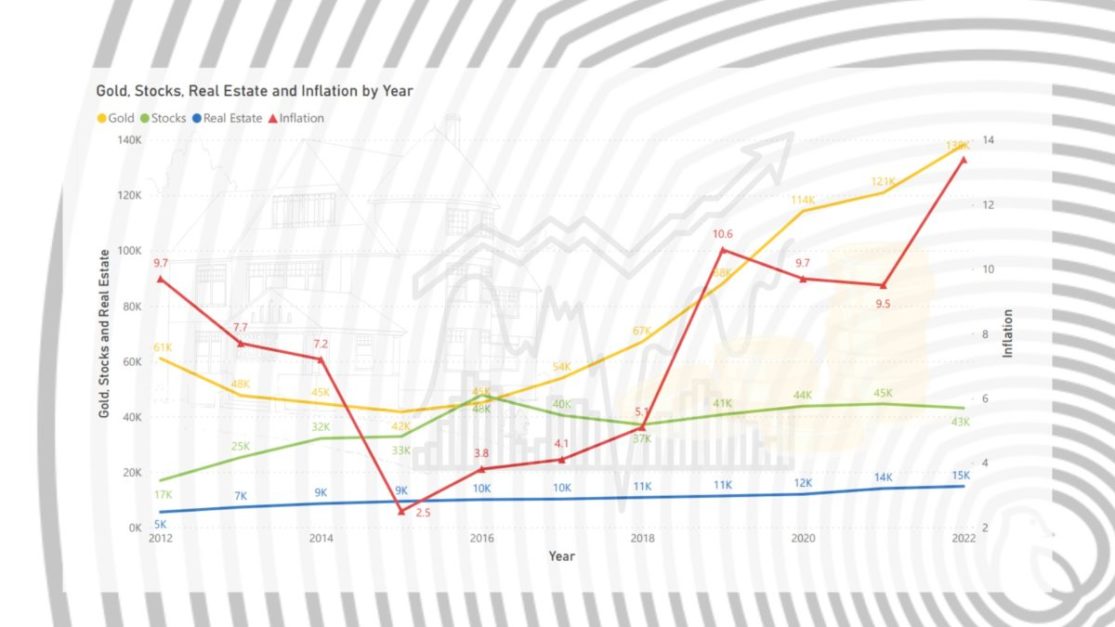

According to the manifestation in the graph above, it is apparent that real estate is the safest and most non-volatile investment option in Pakistan, offering gradual but increasing value over time. Total value of real estate climbed from PKR 5k billion in 2012 to PKR 15k billion in 2022. This 300% jump in 10 years, without even a single dip, clearly indicates the safety and non-volatility of the real estate market.

In comparison, no other investment option is promising an increasing rate of returns. For instance, the stock market jumped from PKR 17k billion in 2012 to PKR 48k billion in 2016, but then descended to 43k.

Moreover, it is also apparent from the graph that all other investment options are affected by inflation, whereas real estate remains unaffected in this case. For instance, when inflation went to just 2.5% in 2015, all other investment options got affected. However, the value of real estate kept increasing gradually.

In a Nutshell

Pakistan’s depleting economy, combined with pockets of political instability, is making the country an unfavourable market for investors. However, the real estate sector still remains a promising investment option that is safe from political perils and helps earn an appreciable profit as it will act as an inflation hedge.

To read more on real estate investment in Pakistan, visit our blog.

Sources

Political Stability Data

https://www.theglobaleconomy.com/rankings/wb_political_stability/

Inflation Figures

https://data.worldbank.org/indicator/FP.CPI.TOTL.ZG?end=2021&locations=PK&start=2012&view=chart

Currency Devaluation Data

https://tradingeconomics.com/pakistan/currency

Stock Market Data

https://tradingeconomics.com/pakistan/stock-market

Asset Allocation Data

Gold Value

https://www.forex.pk/bullion-rates2.php

This blog is quite holistic and it narrow the things in a clear manner. The author presented the facts and figures and analysis collectively. It summed up the current scenario very well comprising political instability, inflation and economic situation as well as real estate factor providing a good piece to read.