In addition to digitising Sindh’s Excise and Taxation Department, the provincial administration has made yet another notable move to assist the residents of Sindh. It recently introduced a website that enables vehicle owners to pay their online motor vehicle tax payment in Sindh. This service saves them the trouble of travelling to the relevant government offices and standing in a queue for hours for this task.

Graana.com has prepared a comprehensive, step-by-step guide below on how you can pay your motor tax online in Sindh if you are facing any confusion on how to do so.

Motor Tax Online in Sindh – Overview

| Service Name | Description |

|---|---|

| Service Provider | Sindh Excise, Taxation & Narcotics Control Department |

| Online Platform | Web portal: Sindh Vehicle Verification |

| Services Offered | 1. Payment of Motor Vehicle Tax Online

2. Verification of Motor Vehicle Ownership |

| Payment Methods | Online payment through various methods such as Credit/Debit Card, Mobile Wallets, etc. |

| User Registration | Users need to create an account on the online portal for availing services. |

| Document Requirements | 1. Vehicle Registration Details

2. CNIC/Smart Card Details |

| Accessibility | Available for residents and vehicle owners in the Sindh province. |

| Customer Support | Contact information is available on the online portal for queries and assistance. |

Guide on How to Pay Motor Vehicle Tax Online in Sindh

The process is extremely straightforward by online Excise and Taxation Sindh, and we have it down in steps for your convenience.

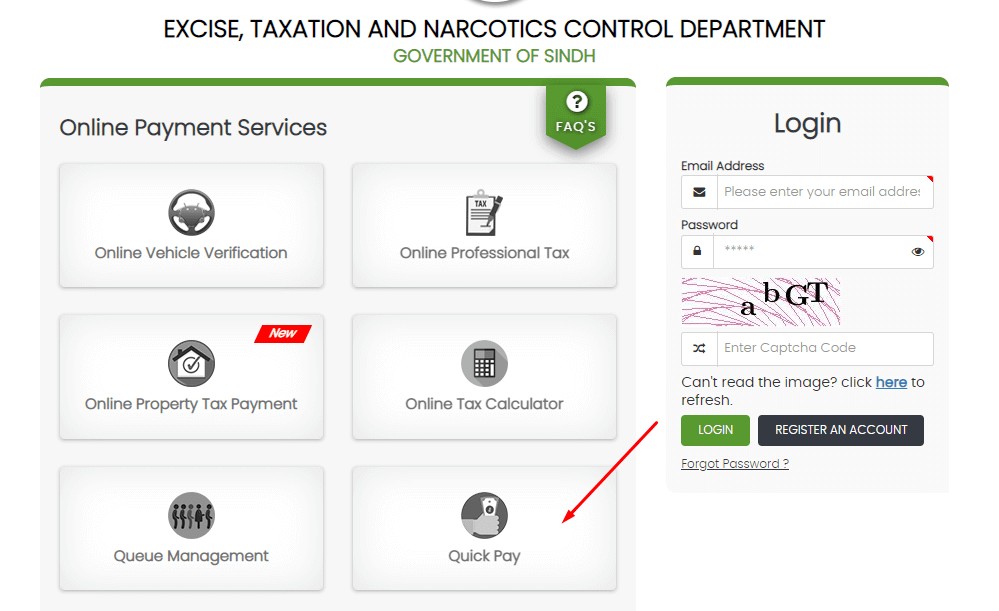

1st Step: Visit the website and enter the required information

- If you want to car tax online, open the official website of the Sindh Excise and Taxation Department.

- There are several alternatives available; you must choose “Quick Online Tax Payment”, as seen in the screenshot.

2nd Step: Calculate the total amount of payable tax

- Once you have submitted the information required, you will be asked to enter your phone number and vehicle registration number.

- The website will then retrieve information about your car. To determine the amount of tax due on your vehicle, choose the taxation period of your choice.

3rd Step: Generate the PSID

- The next step is to create the Public Safety Identification (PSID) after you have calculated the tax due.

- Click the “Generate PSID” button after making sure all the tax information displayed on your screen is accurate.

Other Ways to Pay Motor Tax Online in Sindh

Apart from the process explained in the previous section, there are a few other ways to pay the tax vehicle online in Sindh. These include:

- Interbank

- ATM

- Designed Bank Branch

- Mobile App

How to Pay Motor Vehicle Tax Sindh via Interbanking

- Log in to your online banking account on your desktop or mobile browser.

- Select “Tax Payment” from the list of options given under “Bill Payment”.

- Now choose the “Excise & Taxation” menu item.

- Enter your personal, 6-digit PSID here.

- In accordance with the given PSID number, the system will automatically retrieve the amount of the required tax.

- Make the payment after confirming the amount.

- A notice stating that your transaction was successful will appear on the screen when you have completed the payment.

How to Pay Motor Tax via an ATM

- Visit the closest ATM that provides 1 link facility to its users.

- Select the “Tax Payment” option from the list of bill payment options after entering your ATM PIN.

- Select the “Excise and Taxation” option.

- Please enter your 6-digit PSID for verification.

- In relation to the entered PSID, the amount of tax due will automatically show up on the screen.

- Use your ATM card to pay.

Steps to Pay Motor Tax Designated Bank Branch

- You can go to any bank to pay your vehicle tax.

- Show the cashier a printout of the PSID that was issued.

- Make the payment at the counter with cash or a cheque for the amount of vehicle tax due.

How to Pay Motor Tax via Mobile App

The mobile app developed by the Sindh Excise and Taxation Department allows you to pay your vehicle tax as well. It is available on both the iOS App Store and the Google Play Store. Users of Easypaisa and JazzCash, two apps that are linked to 1 Link’s services, can also pay their motor vehicle tax online in Sindh.

You can also take a look at our comprehensive guide on the Excise and Taxation Department’s online vehicle verification procedure in Sindh.

For more related information, visit Graana Blog.

FAQs

How do I pay my Sindh vehicle token tax online?

To pay your Sindh Excise tax online, follow these steps:

- Visit the official website of the Sindh Excise and Taxation Department.

- Look for the online tax payment section or e-payment portal.

- Select the type of tax you want to pay, such as vehicle, property, or professional.

- Enter the required details, including your vehicle’s registration number, chassis number, engine number, or property tax details.

- Verify the information and calculate the tax amount.

- Choose the online payment method, such as credit/debit card, internet banking, or mobile wallet.

- Complete the payment process by providing the necessary payment information and confirming the transaction.

How do I check my Sindh car tax online?

For online vehicle tax check Sindh, follow these steps:

- Visit the official website of the Sindh Excise and Taxation Department.

- Look for the online tax verification or vehicle tax inquiry section.

- Enter your vehicle’s registration number or other relevant details.

- Submit the information and check the tax status of your car.

Where can I pay my motor vehicle tax in Karachi?

To pay your motor vehicle tax in Karachi, you can visit the excise office in Karachi, designated branches of authorized banks or pay online through the official website of the Sindh Excise and Taxation Department. The specific banks and branches for tax payment may be mentioned on their website or provided during the tax payment process.

Or simply search for ‘car tax check Karachi’ and you will get relevant information.

How to pay vehicle tax online in Pakistan?

To pay vehicle tax online in Pakistan:

- Identify the relevant excise and taxation department of your province or region.

- Visit their official website and navigate to the online tax payment section.

- Select the type of vehicle tax you want to pay, such as token tax or registration fee.

- Provide your vehicle’s registration number or other necessary details.

- Verify the information and calculate the tax amount.

- Choose the online payment method and complete the transaction.