As we step into a new area of technology, visiting the bank has become a dated concept. With the rise in web-based alternatives, more and more people are switching to digital banking services in Pakistan – especially to avoid waiting in long queues just to pay bills or send money abroad. Recently, a new player has emerged in the Pakistani market, named of SadaPay.

SadaPay is a safe and smart online money management platform that is designed to streamline domestic and international payments in the nation. By using the SadaPay app, you can open an account and even get a physical card without any registration fees.

Graana.com has discussed everything you need to know about SadaPay below, including its features, services, and the advantages of using this digital platform.

Summary of SadaPay

| Category | Details |

|---|---|

| Services | Personal and business financial services, including Mastercard debit cards and a digital wallet. |

| Sign-Up Process | – From Pakistan: CNIC, selfie, and a few clicks (less than 2 minutes).

– From abroad: International mobile number and NICOP or Pakistan origin card (POC) for quick sign-up. |

| Features | – Send money quickly.

– Pay bills for 900+ billers. – Request money easily. – Top-up any GSM network instantly. – Physical and virtual cards available. |

| SadaBiz | Tailored for freelancers to accept international payments at the best FX rates. |

| Security Features | – Biometric access using fingerprint or Face ID.

– AI Fraud Detection for enhanced security. – Encryption for the protection of funds and personal data in transit and at rest. |

| Customer Support | 24/7 in-app support via chat. |

| Regulation | Regulated by the State Bank of Pakistan. |

| User Base | Over 1 million happy users. |

| App Ratings | – App Store: 4.8

– Google Play: 4.6 |

| Legal Information | SadaPay is registered as Sadapay Private Limited with the Securities and Exchange Commission of Pakistan (No. 0136598).

It is regulated by the State Bank of Pakistan and is a wholly-owned subsidiary of SadaPay Technologies Ltd. |

| Mastercard License | SadaPay Mastercard debit cards are issued under a license by Mastercard Asia/Pacific Pte. Ltd. |

| Offices | – Head Office: Ufone Tower, Islamabad.

– Lahore Office: Naveena Tower, Lahore. – Karachi Office: MA Tabba Foundation Building, Karachi. – UAE Office: FinTech Hive, Dubai. – UK Office: Paul Street, London. |

| Contact Information | https://sadapay.pk/contact |

| Website | SadaPay Official Website |

What Is SadaPay?

SadaPay is a digital payment platform that allows users to make and receive payments online. It enables individuals and businesses to securely transfer money to another party through the mobile app, online banking, or via a virtual or physical debit card.

SadaPay also provides services such as bill payments, remittances, and more. It is designed to be a fast, efficient, and convenient alternative to traditional banking methods as well as other digital payment platforms.

Setting Up An Account

To sign up for SadaPay, a user would need to provide some basic personal information. This includes their name, email address, and phone number. They may also be required to verify their identity by providing a government-issued ID or passport. Once the user has completed the verification process, they will be able to set up their account by creating a username and password.

When the account has been set up, the user can use the platform to make transactions, pay bills, and transfer money to other accounts. They can also access their transaction history and account information through the SadaPay app or website.

Additionally, the user can also add multiple payment methods to the account such as bank account and debit card, etc. Once the payment methods are added, the user can select the desired payment method for each transaction.

Sending and Receiving Payments

Once your account is set up, you can send a payment by entering the recipient’s phone number, and the amount you wish to send. Likewise, you can also request money from anyone instantly through the same process.

Security Features of SadaPay

SadaPay has taken several measures to protect its users’ personal and financial information. Some of these features include:

- Two-factor authentication: This adds an extra layer of security to your account by requiring you to enter a code sent to your phone or email in addition to your password when logging in.

- Encryption: SadaPay uses encryption to protect your personal and financial information as it is transmitted over the internet.

- Fraud detection: It also uses advanced fraud detection systems to monitor transactions and detect suspicious activity.

- Biometric authentication: SadaPay supports biometric authentication, such as fingerprint and facial recognition, to ensure that only authorised users can access the account.

- Secure storage of sensitive information: It uses secure servers to store your personal and financial information, which are protected by multiple layers of security.

- Regular security updates: SadaPay regularly updates its systems and infrastructure to protect from the latest security threats.

It’s always recommended to enable all security features, use a strong password, and be aware of phishing attempts, to keep your account and personal information safe.

Advantages of Using SadaPay

Listed below are some of the benefits of using SadaPay.

- Low transaction fees

- Fast and efficient transactions

- Easy and user-friendly interface

Low Transaction Fees

One of the biggest advantages of using SadaPay is that it comes with minimal transaction fees. They are significantly lower compared to traditional banks and other financial institutions. This can be especially beneficial for businesses that process a large volume of transactions, as the lower fees can result in significant savings over time.

Low transaction fees on SadaPay can also be beneficial for individuals. It allows them to save money when making online purchases or sending money to friends and family.

SadaPay’s low transaction fee structure also enables micropayments, which is a small sums of money, to be processed at a low cost. This can especially help small businesses and freelancers.

Fast and Efficient Transactions

SadaPay’s digital payment infrastructure is designed to process transactions quickly and securely. Additionally, with SadaPay, you can make transactions with just an email or phone number. This makes it more convenient for both parties.

SadaPay also offers a range of payment options, including debit cards, bank transfers, and e-wallets, which can further increase the efficiency of transactions. This can help reduce the time and costs associated with traditional payment methods, such as writing and mailing checks.

Easy and User-Friendly Interface

SadaPay’s platform is designed with a simple and intuitive layout. This makes it easy for users to navigate and access different features.

SadaPay also has a mobile app, which allows users to access the platform from their smartphones and tablets. It has a similar interface to the website. This makes it easy for users to make payments and manage their accounts on the go.

Additionally, SadaPay offers detailed statements, which allow users to view and keep track of their past transactions. This can be very useful for businesses. It can help them keep track of their finances, and also for individuals to keep track of their spending.

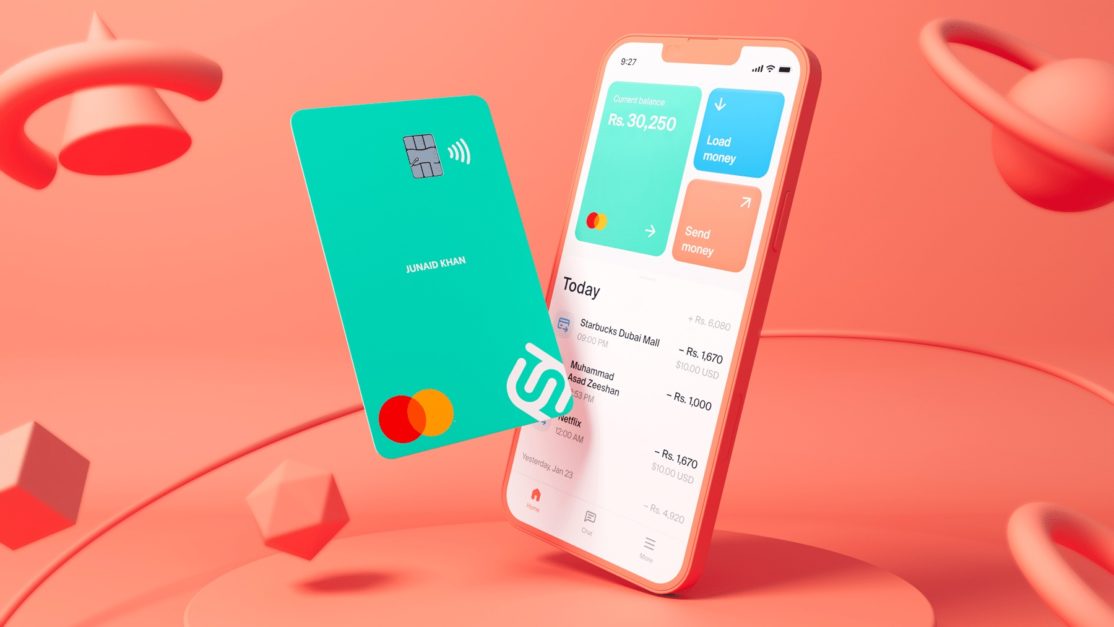

Virtual and Physical Debit Cards

SadaPay offers both virtual and physical debit cards.

Virtual debit cards

These can be generated within the SadaPay app and can be used for online and in-app purchases. They can also be used to make payments on websites and apps that accept Mastercard.

Physical debit cards

SadaPay also offers physical debit cards that can be used to make purchases at physical stores and withdraw cash from ATMs. These are linked to the user’s SadaPay account and can be used anywhere Mastercard is accepted.

For related information regarding another digital payment method such as Raast, visit Graana blog.