The Federal Board of Revenue of Pakistan (FBR) is the central agency of the Pakistani government that is responsible for the administration of taxation and customs duties in the country. The board was established in 1924, and has since played a crucial role in the development and growth of the national economy.

The FBR’s primary objectives are to implement government policies related to taxation and customs duties, collect revenue on behalf of the government and ensure tax compliance, and provide taxpayers with the necessary guidance and support to fulfil their tax obligations.

The FBR operates through its headquarters in Islamabad and regional offices located in major cities across Pakistan. The board’s tax administration system is divided into three main categories: income tax, sales tax, and customs duty.

Graana.com gives a detailed overview of the Federal Board of Revenue below, as well as the registration process of different types of businesses.

Income Tax

The FBR is responsible for the administration of income tax laws in Pakistan. The board’s Income Tax department is responsible for collecting taxes from individuals and companies, conducting tax audits, and providing taxpayers with any guidance that they require. It operates through its regional offices located in the major cities of Pakistan.

Income tax is usually classified into two categories: personal income and business income. The procedures for registering for both types of income tax are different.

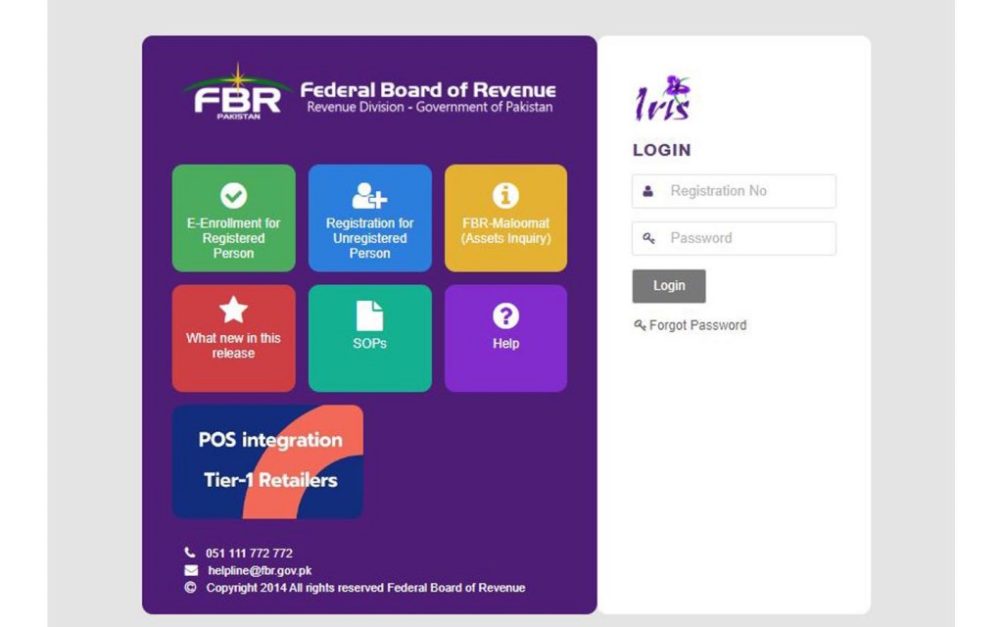

Individuals can register for personal income tax online through the Iris Portal, but for business income tax, the owner of the company or the principal officer of an Association of Persons (AOP) must visit the Regional Tax Office (RTO) in person to complete the FBR registration process.

About Income Tax Registration

- Individual taxpayers can easily register through the Iris Portal.

- Each person’s CNIC number is recognised as their National Tax Number (NTN) or Registration Number.

- Upon visiting the RTO, companies, and AOPs can undergo e-enrolment with the FBR to receive a unique 7-digit NTN.

- This NTN or CNIC number can be used to log into the Iris Portal and file income tax returns online.

Documents Required by FBR for Income Tax Registration

To complete the FBR registration process, you will need to give the following details.

For Individual Taxpayer

- CNIC/passport number/NICOP

- Cell phone number

- An active email address

- Nationality

- Residential address

- Accounting period/fiscal year of registration

- Business name and address in case of business income

- Primary business activity

- Employer’s name and NTN in case of salary income

- Address of the property in case the revenue comes from a property

For Local Business

- Name of AOP or company

- Name of business

- Business’s address

- Phone number of the business

- Valid email address

- Main business activity

- Company type (public ltd., private ltd., trust, NGO etc.)

- Accounting period/fiscal year of registration

- Cell phone number of the principal officer of the AOP or company

- Date of registration

- Incorporation certificate by the Securities and Exchange Commission of Pakistan (SECP) – for companies only

- Partnership deed and registration certificate if it is a registered firm

- Partnership deed for a non-registered firm

- Trust deed for a trust

- Registration certificate for a society

- Name of the company representative with CNIC/NTN

- Name, CNIC/NTN/Passport number, and share percentage of every director, partner, or major shareholder with more than 10% shares

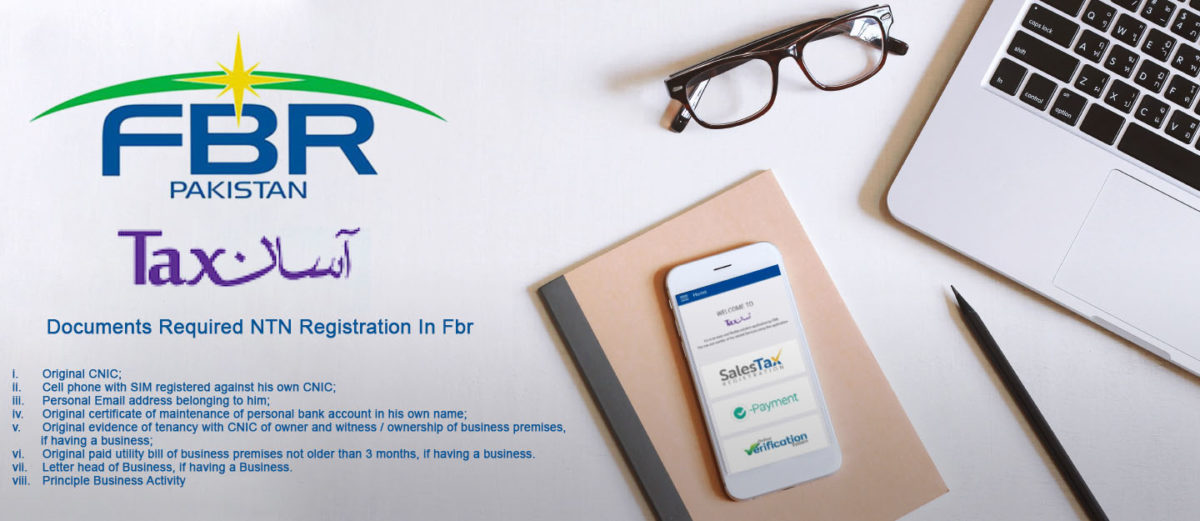

FBR Registration Process for an Individual

Individual taxpayers can register with the Federal Board of Revenue (FBR) through the Iris Portal online. Before beginning the registration process, it is recommended to read the User Guide.

A computer, scanner, reliable internet connection, cell phone number linked to your CNIC and personal email address are required to complete the online process.

The following documents in PDF format must also be gathered:

- Bank account maintenance certificate for your personal account

- Evidence of ownership or tenancy of business premises (if you own a business)

- Paid utility bills for the business premises from the past three months (if applicable)

Alternatively, the FBR registration process can be completed in person by visiting a Tax House with the required documents and information mentioned above.

FBR Registration Process for a Local Business

To complete the FBR registration process for companies and AOPs, one member or partner must visit the local Tax House and provide the following required documents:

- Original partnership deed of the firm

- Original registration certificate from the Registrar of Firms

- Incorporation certificate (for a company)

- CNICs of all members, partners, or directors

- A letter on the company’s letterhead, signed by all members, partners, or directors, authorising one person to handle the income and sales tax registration with the FBR

- A cell phone number of the authorised person (not previously registered with the FBR) issued against their own CNIC

- Email address of the company or AOP

- Bank account maintenance certificate in the name of the company

- Evidence of business premises ownership or tenancy

- Paid utility bills for the past three months associated with the business premises

Federal Board of Revenue Sales Tax

The FBR is also responsible for the administration of sales tax laws in Pakistan. The board’s Sales Tax department is responsible for collecting taxes on the sale of goods and services, conducting tax audits, and providing taxpayers with required support. The Sales Tax department operates through its regional offices located all across Pakistan.

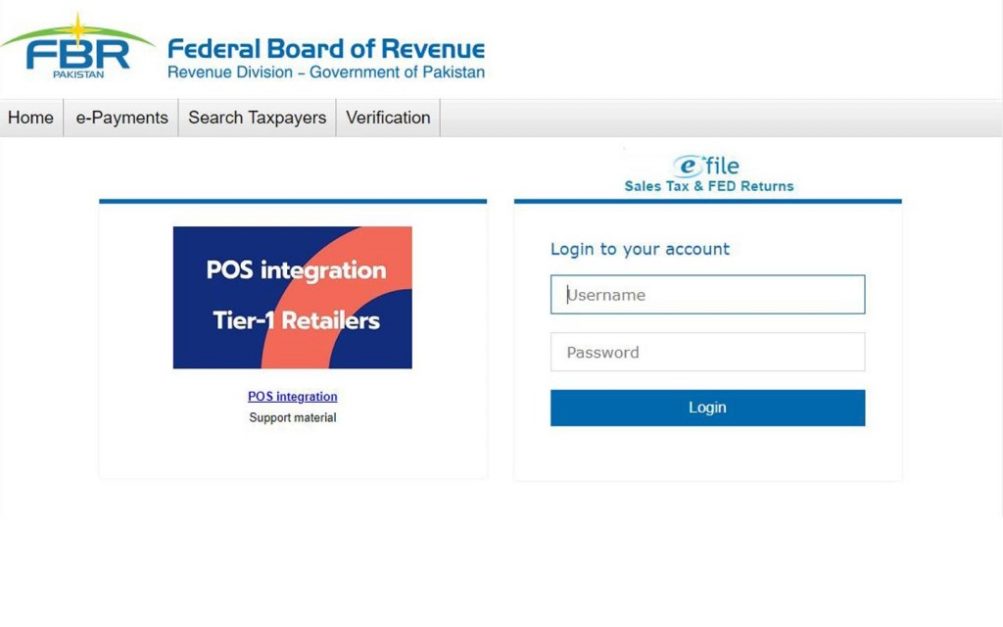

All individuals and businesses involved in importing, manufacturing, wholesaling, and retailing must register themselves with the FBR. To register for sales tax, you must have a valid account on the Iris portal. Upon registration, the FBR will assign you a Sales Tax Registration Number (STRN). With this information, you can access the e-file portal to submit your sales tax returns.

Registration Process for Sales Tax

Follow the steps below to register for sales tax on the Iris Portal:

- Select “Form 14(1) (Form of Registration Filed voluntarily through Simplified) (Sales Tax)” from the Registration drop-down menu.

- Provide the following information:

- Taxation period

- Type of registration (manufacturer or non-manufacturer)

- CNIC as a member, director, or principal officer of the company

- Bank account maintenance certificate in the business name

- Details of the business (name, activity, acquisition date, branches, etc.)

- Photographs of the business premises and utility meters (with registration numbers)

- Photographs of machinery and industrial meters for manufacturers

- You may be contacted by the FBR for additional documentation.

- Within 30 days of registering, complete biometric verification at a NADRA e-Sahulat Centre or your registration will be cancelled.

An alternative to registering through the Iris Portal is the Tax Asaan app.

Customs Duty at the Federal Board of Revenue

The FBR’s Customs department is responsible for the administration of customs duties in Pakistan. The department is responsible for collecting customs duties on imported and exported goods, conducting customs audits, and assisting taxpayers in case they require any guidance. The Customs department operates through its regional offices located throughout Pakistan.

In addition to tax administration, the FBR also plays a crucial role in the development of tax policies in Pakistan. The board is responsible for conducting research and analysis of tax laws and policies, making recommendations to the government on tax reforms, and implementing new tax policies as directed by the government.

Types of Custom Duty at the Federal Board of Revenue

To be eligible for Customs Registration, you must meet the specified criteria. This type of tax is only applicable for:

- Traders

- Customs agents

- Bonded carriers

- Shipping lines

- Warehouses

Several different types of traders fall into this category, including:

- Commercial traders

- Non-commercial traders

- Shipbreakers

- Trusts or non-profit organisations

- Government departments

- Courier services

- Diplomatic cargo for embassies

FBR Registration Process for Custom Duty

To log in to the Web Based One Customs (WeBOC), the FBR’s Customs portal, you must first register with the FBR by completing a registration form. The form requires:

- Your NTN

- Your STRN

- The name of the business

- Business’s address

- Contact person’s name, CNIC, and email ID

- Two phone numbers

- Fax number

- Cell phone number

- Your bank’s name, branch, and city

- Account number

- Licence number

- Warehouse details (if relevant)

- Shipping line type (if relevant)

- Location (for terminal operators)

It’s important to also visit the RTO for biometric verification. The FBR may also visit your business premises. After submission, you will be notified of the acceptance or rejection of your application.

If accepted, you will receive a login ID and password for WeBOC. Keep in mind that revalidation may be required in the future.

WeBOC at the Federal Board of Revenue

The WeBOC system is a web-based platform for automated customs clearance in Pakistan. It facilitates the seamless clearance of imports and exports.

With over 45,000 registered users, including government agencies and private businesses, it has made customs processes faster and more efficient by eliminating manual systems. You can find more information about WeBOC on the FBR website.

FBR Guidance Process

The FBR’s Taxpayer’s Services Division provides taxpayers with information on tax laws, procedures, and forms, as well as assistance with tax returns and other tax-related matters.

The FBR has taken several initiatives in recent years to improve tax compliance and increase revenue collection. The board has introduced several online services for taxpayers, including online tax returns, online tax payments, and online tax assessments.

The FBR has also introduced a tax identification number (TIN) system, which allows taxpayers to complete their tax returns and make tax payments online.

Importance of Being a Tax Filer in Pakistan

It is important to be a tax filer in Pakistan for several reasons:

Legal Obligation at Federal Board of Revenue

Filing taxes is a legal requirement for all citizens and businesses, and failure to do so can result in penalties and fines.

Good Citizenship

Filing taxes contributes to the development of the country and helps the government provide necessary services to its citizens.

Improved Credit Standing

Filing taxes regularly helps establish a good credit history, which can be useful when applying for loans, credit cards, and other financial products.

Access to Government Services

Filing taxes is often a requirement for accessing certain government services, such as obtaining a passport or a driving licence.

Avoids Future Legal Consequences

Regularly filing taxes helps avoid future legal consequences, such as audits, fines, or even jail time.

Promotes Trust

Filing taxes promotes trust in the system, as well as accountability and transparency in the tax collection process.

FAQs About the Federal Board of Revenue (FBR)

The following are some of the most frequently asked questions about the Federal Board of Revenue (FBR):

What is the Federal Board of Revenue (FBR) in Pakistan?

The Federal Board of Revenue (FBR) is the principal tax collection agency in Pakistan, responsible for collecting taxes, duties, and levies on behalf of the federal government.

What is the main function of FBR?

The main function of the FBR is to enforce tax laws, collect tax revenues, and administer tax policies in an efficient and transparent manner.

Who is responsible for the administration of FBR?

The administration of the FBR is the responsibility of its Chairman, who is appointed by the President of Pakistan on the recommendation of the Prime Minister.

What types of taxes are collected by the FBR?

The FBR collects a wide range of taxes, including income tax, sales tax, federal excise duty, and custom duties.

How does the FBR ensure compliance with tax laws?

The FBR enforces compliance with tax laws through various means, including tax audits, investigations, and enforcement actions. It also provides tax education and assistance to taxpayers to encourage compliance.

What is the role of FBR in formulating tax policies in Pakistan?

The FBR plays a crucial role in formulating tax policies in Pakistan by providing expert advice and recommendations to the government on tax-related issues.

Can individuals file their taxes online through the FBR’s website?

Yes, individuals can file their taxes online through the FBR’s website by registering for e-filing and accessing the online tax portal.

What happens if a taxpayer fails to file their taxes or pay their taxes in full?

If a taxpayer fails to file their taxes or pay their taxes in full, they may be subject to fines, penalties, and enforcement actions, including wage garnishments, bank account seizures, and legal proceedings.

Can the FBR provide assistance to taxpayers with tax-related questions?

Yes, the FBR provides assistance to taxpayers with tax-related questions through its customer service center, website, and offices located throughout the country.

How does the FBR ensure the confidentiality of taxpayer information?

The FBR takes the confidentiality of taxpayer information very seriously and has implemented strict security measures to protect taxpayer data. It is also bound by legal restrictions on the use and disclosure of taxpayer information.

What FBR Means?

FBR stands for Federal Board of Revenue, which is a government entity in Pakistan responsible for taxation and revenue collection.

For more information, visit the Graana Blog