Pakistan’s real estate market is one of the most dynamic and promising sectors, offering opportunities for growth, investment, and homeownership. However, for first-time buyers, navigating this market can be daunting due to its complexity and evolving trends. This guide is designed to provide essential insights into Pakistan’s real estate landscape, helping you make informed decisions and avoid common pitfalls.

Understanding Pakistan’s Real Estate Landscape

The real estate sector in Pakistan is diverse, catering to a wide range of needs and preferences. Here’s what you need to know:

Key Cities and Regions

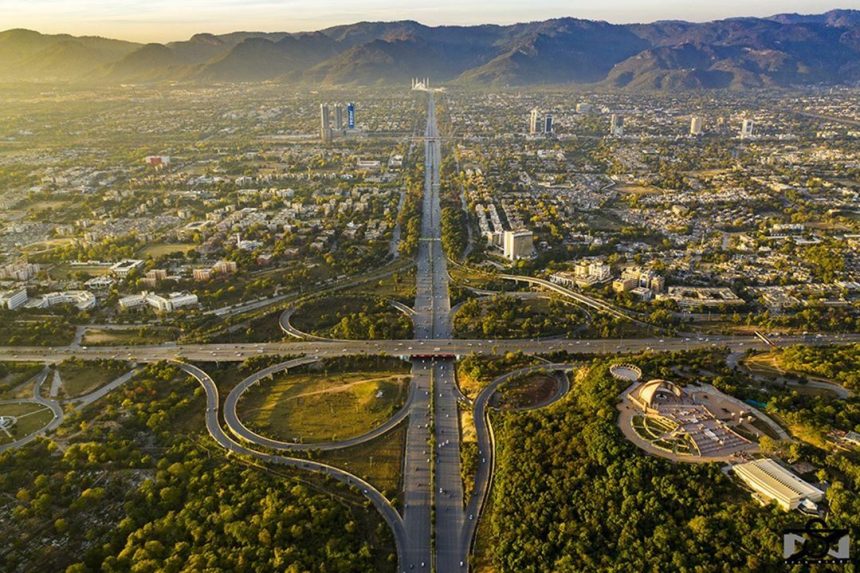

- Islamabad: Known for its planned infrastructure and high-quality residential projects.

- Lahore: A hub for cultural and commercial activity, offering a mix of modern and traditional properties.

- Karachi: Pakistan’s financial capital with a bustling real estate market.

- Gwadar: Emerging as an investment hotspot due to the China-Pakistan Economic Corridor (CPEC).

Types of Properties

- Residential: Houses, apartments, and plots within gated communities or standalone developments.

- Commercial: Shops, offices, and mixed-use properties in commercial hubs.

- Plots: Both residential and commercial plots for custom construction.

Investment Trends

- Gated communities and luxury apartments.

- Mixed-use developments combining residential, commercial, and recreational facilities.

- High-demand projects in prime locations like DHA, Bahria Town, and IMARAT Downtown.

Researching the Market

Knowledge is power when entering the real estate market. Here’s how to stay informed:

- Track Market Trends: Keep an eye on property prices and market demands through online portals like Zameen.com and Graana.com.

- Reputable Developers: Research well-known developers with a track record of timely delivery and quality projects.

- Visit Local Communities: Engage with locals to understand property values, community features, and safety.

Budgeting and Financial Planning

Real estate purchases require thorough financial preparation. Consider the following:

Calculate Your Budget

- Assess your financial capacity, factoring in monthly income and savings.

- Determine how much you can allocate for a down payment and monthly installments.

Explore Financing Options

- Mortgage Loans: Offered by banks like HBL and Meezan Bank.

- Installment Plans: Many developers offer flexible payment schedules.

- Personal Savings: An interest-free option but requires substantial upfront capital.

Account for Hidden Costs

- Taxes: Stamp duty, Capital Gains Tax (CGT), and withholding taxes.

- Transfer Fees: Charged during the ownership transfer process.

- Agent Commissions: Usually 1-2% of the property value.

- Maintenance Costs: For gated communities or apartments.

Navigating the Buying Process

Purchasing property involves multiple steps. Here’s a roadmap:

- Shortlist Properties: Based on your needs, location preferences, and budget.

- Conduct Site Visits: Inspect the property’s condition and surroundings.

- Negotiate the Price: Engage in discussions with sellers or agents to secure the best deal.

- Verify Documentation: Ensure the property is free of legal disputes and properly registered.

- Finalize the Transaction: Complete legal formalities and transfer ownership.

Tip: Hire a lawyer to review documents and ensure smooth processing.

Legal and Regulatory Considerations

Understanding the legal aspects is crucial to avoid scams and disputes:

- Verify Approvals: Ensure the project is approved by relevant authorities like CDA (Capital Development Authority) or LDA (Lahore Development Authority).

- Check Ownership Records: Confirm the property’s ownership and ensure no pending liabilities.

- Avoid Scams: Be cautious of deals that seem too good to be true and always cross-check with official records.

Tips for First-Time Buyers

Buying your first property is a significant milestone. Here are some do’s and don’ts:

Do’s:

- Research Thoroughly: Understand the market, property values, and future prospects.

- Start Small: Invest in affordable properties to minimize risk.

- Prioritize Location: A good location ensures better returns and convenience.

Don’ts:

- Overstretch Your Budget: Stick to what you can afford comfortably.

- Skip Legal Checks: Always verify documents to avoid future issues.

- Rush Decisions: Take time to analyze all aspects before committing.

Highlighting Promising Projects

For first-time buyers, trusted projects offer peace of mind and potential growth. Consider:

- Gated Communities: Bahria Town, DHA, and Park View City

- Installment-Friendly Options: Projects by IMARAT, offering flexible payment plans

- High-ROI Developments: Mixed-use projects like IMARAT Downtown, which combine residential and commercial spaces

Common Challenges and How to Overcome Them

Challenges:

- Lack of reliable information

- Market fluctuations

- Decision-making anxiety

Solutions:

- Seek advice from experienced professionals

- Diversify your research sources

- Break down the decision-making process into manageable steps

Conclusion

Buying your first property in Pakistan can be both exciting and overwhelming. With proper research, financial planning, and a cautious approach, you can make a confident and rewarding decision. Start exploring promising projects, consult experts, and take the first step towards owning your dream property today.

For more related information, visit Graana Blog.