Getting an interest-free loan from the bank is the best solution for purchasing or buying your first home. While there are myriad home loan options in Pakistan, Meezan Bank Home Loan is the best in providing shariah-compliant financing facilities to customers.

This home loan isn’t based on lending or borrowing money but on joint property ownership. It transfers complete ownership once the full payment has been made, according to the agreement.

If you want home financing from Meezan, Graana.com, Pakistan’s smartest property portal, provides a complete guide below.

Key Features of Meezan Bank Home Loan

Some of the key features of the home loan are given below.

- It provides the opportunity to obtain a large number of finances.

- It gives you the option of making partial prepayments.

- This home loan provides a shariah-compliant life-takaful facility.

- It provides affordable instalments with a periodic reduction in monthly rentals.

Meezan Home Loan Product Categories

The most significant advantage of Meezan Bank is that it offers home loans in Pakistan for various categories, as mentioned below.

Meezan Easy Buyer

Meezan Bank is one of the top Banks Providing Home Loans in Pakistan. In this category, the applicant can get a loan of a minimum PKR 500,000/- to a maximum of 50 million. The tenure can range from 3 to 20 years. The bank provides a 75% financing facility to salaried individuals and 65% to businessmen/self-employed individuals. In the easy buyer category, you choose an already constructed house.

Meezan Easy Builder

In this category, you get a loan for building a home on an already-owned piece of land. You get financing facilities in the range of PKR 5 million to 50 million. The facility’s tenure is from 2 to 20 years, exclusive of the construction period.

Meezan Easy Renovate

With the ‘easy renovate’ option, you can get a financing facility in the PKR 5 to 10 million range. The loan tenure will be 2 to 15 years. You can renovate your home through this loan to add more value to the property. The bank will finance 30% of the total needed to renovate a property.

Meezan Easy Replace

This is another home loan scheme in Pakistan. In the ‘easy replace’ loan, you can transfer your home loan from any other bank to Meezan Bank.

You get a loan in the range of PKR 5 million to 50 million for 3 to 20 years. The bank will finance 75% of the total amount to salaried persons and 65% to businessmen/self-employed persons.

Payment Models to Avail Home Loan

There are two payment models to get a home loan:

- UMI Model

- Step-up Model

UMI Model

In the UMI model, the bank and customer enter into an agreement with the purpose of making investments to construct, purchase and renovate the property. This concept is called diminishing musharakah.

Under this concept, the bank share is divided into units that customers purchase by paying monthly instalments. After paying the instalments on a regular basis, the customer becomes the owner of the property.

Step-up Model

In the step-up model, the customer gets the opportunity to pay lower monthly instalments at the start that he/she can afford to pay. The bank share is divided into musharakah units.

Initially, the customer buys one unit of the musharakah from the bank every month and, after a while, the customer buys two units of musharakah every month from the bank.

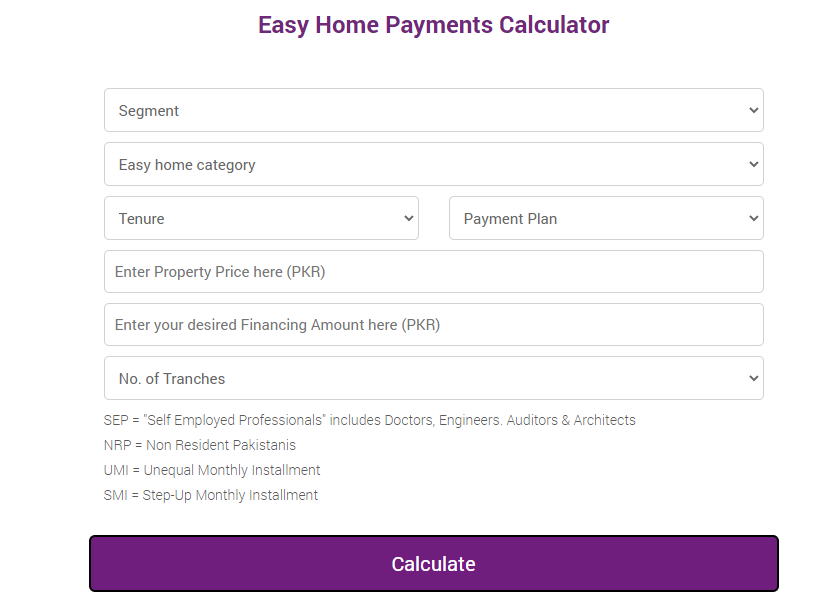

Meezan Home Loan Calculator

To calculate the monthly instalments of the loan, you can use the Meezan bank home loan calculator to plan the financing according to your needs. In the calculator, you can choose tenure, financing amount, payment plan etc. Once you have selected all options, you get the exact monthly instalment that you would have to pay to the bank.

How to Get a Home Loan from Meezan Bank

Most of the time, obtaining a loan from the bank depends on your credit history, income and some other factors. Usually, banks take a look at the three C’s, which include character, capacity and collateral.

Character

In banking terms, this is a way of checking that you have not defaulted on any payment or loan commitments to anyone. You can get all your credit history from your bank and provide it at the time of your loan application.

Capacity

If your net income is more than all your spending, including the new loan payment, then banks will not have any difficulty in lending you money. They will check other aspects as well, but this is their primary way of checking that you can afford the repayment of loans.

Collateral

This refers to an asset that a lender accepts as security for a loan. If a person is unable to repay the loan, then the bank has the authority to take possession of that asset that was offered by the borrower.

Hence, it is important for the applicants to structure their home loan application according to these three C’s.

Eligibility Criteria for Meezan Home Loan

Following are the eligibility criteria for Pakistani residents to get a home loan from Meezan Bank.

- The applicant should be a Pakistani national.

- The age of the primary applicant must be a minimum of 25 years of age and a maximum of 65 years of age at the time of maturity.

- If a co-applicant is in a home loan, the minimum age is 21 years and must be 70 years at the time of financing maturity.

- For a salaried person, the financing maturity should not exceed their retirement date.

- In the case of a self-employed/businessman, the age of the co-applicant should be 65 years at the time of financing maturity.

- Any individual can avail this home loan as a primary applicant or co-applicant. But a co-applicant must be an immediate family member.

- In the case of a salaried individual, the individual must have an income of PKR 40,000/- per month. For self-employed/businessmen, the minimum income is set at PKR 75,000/- per month.

- For salaried persons, him/her must have a steady job. The person must work in the same industry for at least two years. For businessmen/self-employed, it is at least 3 years of continuous work in the same business/industry.

Requirements for Non-Resident Pakistanis

Following are the requirements for Pakistanis who are living abroad.

- The applicant must be a Pakistani national.

- The applicant’s age must be a minimum of 25 years and a maximum of 60 years at the time of financing maturity.

- The minimum income should be equivalent to PKR 150,000/- or above per month.

- The individual should have a minimum of 2 years of work experience in the same industry, and a minimum of 1 year of continuous work in the existing job in the same industry.

This loan facility is only for salaried individuals who are living in any foreign country.

Required Documents

The following are the required documents to apply for the Meezan home loan.

- Copy of applicant’s valid CNIC and co-applicant CNIC (if applicable)

- Two latest passport size photographs of applicant/co-Applicant

- Photocopy of last paid bills of electricity/telephone/gas

- Copy of CNICs of legal heirs

- Photocopy of recent credit card bills and other credit facilities (if applicable)

- Photocopy of professional degree/certificate (if applicable)

- Copy of rent agreement if applicable

- Declaration of good health for Life Takaful

Income Information

To get a loan from the bank, you need to provide proof of your income. For your convenience, we have listed the required documents for both salaried and self-employed individuals.

Salaried Individuals

- Letter of employment including salary, date of joining and designation

- Original or verified copy of salary slip for last three months

- Bank statement for the last 12 months

Businessman and Self Employed individuals

- Proof of business for the last 3 years, such as providing a tax return or bank certificate

- Photocopy of NTN certificate and last three years’ tax returns

- In the case of a partnership, the partnership deed is needed

If you want the financing for buying, constructing, replacing, or renovating a property, you must provide all the necessary property-related documents. At the time of application, you need to provide only the copies and before the disbursement of the loan, original documents are to be handed in.

Application Procedure

Once you have all the required documents, it is time to apply for the loan. Following is the complete process of a loan application.

- Submit the loan application form to any nearest Meezan Bank branch with all the required documents. The form should be duly signed and filled out.

- Once the application is submitted, the bank will verify your residential/office addresses.

- After the verification, the bank will assess your credit history and conduct complete due diligence of your financials according to the provided information.

- In the next step, the bank will appoint a valuation agency to determine the property’s market value.

- After completing all the verification, the bank will give you the conditional offer letter. If you don’t have a Meezan Bank account, you would be required to open one.

- Once your case is approved, you must sign the financial agreement and other legal documents.

- Finally, the bank will hand over the original documents to the lawyer for verification, after which the loan will be given to you.

If you’re considering buying a new house, Meezan Bank is your best choice for getting a home loan as it offers Shariah-compliant home loans to borrowers.

For more information regarding home loans or the steps of construction of the home, follow Graana blog.

FAQs

Which bank is best for a house loan in Pakistan?

When it comes to house loans in Pakistan, there are several banks that offer attractive interest rates and flexible repayment terms, including Meezan Bank, HBL, UBL, Askari Bank, and others. The best bank for a house loan would depend on your specific requirements, such as loan amount, tenure, interest rate, and other factors.

What is the interest rate of Meezan Bank loan?

Regarding the interest rate of Meezan Bank loan, it can vary depending on the specific loan product and terms. It’s best to contact the bank directly or visit their website to check the latest interest rates.

How can I apply for Apna Ghar scheme?

To apply for the Apna Ghar scheme, you can visit the official website of the National Database and Registration Authority (NADRA) or contact the relevant authorities for more information. The Apna Ghar scheme is a government-backed initiative to provide affordable housing solutions to low-income families.

What is the interest rate of an easy loan?

Regarding the interest rate of an easy loan, it can vary depending on the lender and specific loan product. It’s best to compare different lenders and check their interest rates, repayment terms, and other factors before deciding.